You are here:Aicha Vitalis > trade

Bitcoin Long Run Price: A Comprehensive Analysis

Aicha Vitalis2024-09-22 04:23:16【trade】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the first and most well-known cryptocurrency, has been a topic of great interest and debate airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the first and most well-known cryptocurrency, has been a topic of great interest and debate

Bitcoin, the first and most well-known cryptocurrency, has been a topic of great interest and debate among investors, economists, and enthusiasts alike. One of the most frequently asked questions is: What will be the long-run price of Bitcoin? In this article, we will explore various factors that could influence the long-run price of Bitcoin and provide a comprehensive analysis.

Firstly, it is essential to understand that predicting the long-run price of Bitcoin is inherently challenging due to its volatile nature. However, by examining historical trends, technological advancements, and market dynamics, we can gain valuable insights into its potential future price trajectory.

1. Historical Trends

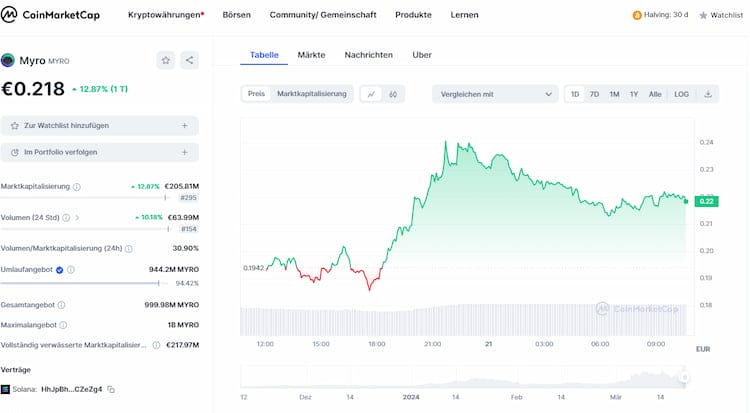

Bitcoin has experienced significant price volatility since its inception in 2009. The cryptocurrency has seen both rapid growth and sharp declines, with its price reaching an all-time high of nearly $20,000 in December 2017. While it is difficult to predict the exact long-run price, historical trends suggest that Bitcoin has the potential to appreciate over time.

Looking at the long-term price chart, we can observe that Bitcoin has exhibited a strong upward trend. This trend can be attributed to several factors, including increasing adoption, regulatory developments, and technological advancements. As more individuals and institutions recognize the value of Bitcoin as a digital asset, its demand is likely to rise, potentially driving its long-run price higher.

2. Technological Advancements

Bitcoin's underlying technology, blockchain, is a key factor that could influence its long-run price. Blockchain technology is designed to be secure, transparent, and decentralized, which makes it an attractive solution for various industries. As more businesses and organizations adopt blockchain technology, the demand for Bitcoin could increase, leading to a higher long-run price.

Moreover, ongoing technological advancements in the Bitcoin network, such as the implementation of the Lightning Network, could further enhance its scalability and efficiency. This could make Bitcoin more attractive as a medium of exchange and a store of value, potentially driving its long-run price higher.

3. Market Dynamics

Market dynamics play a crucial role in determining the long-run price of Bitcoin. Factors such as regulatory frameworks, institutional adoption, and macroeconomic conditions can significantly impact the cryptocurrency's value.

Regulatory developments have been a major concern for Bitcoin investors. While some countries have embraced cryptocurrencies and implemented favorable regulations, others have imposed strict restrictions or outright banned them. As regulatory frameworks become more favorable, Bitcoin's long-run price could benefit from increased adoption and investment.

Institutional adoption is another critical factor. As more institutional investors enter the cryptocurrency market, they are likely to drive demand for Bitcoin, potentially pushing its long-run price higher. This trend is already evident, with several large financial institutions and investment firms investing in Bitcoin and other cryptocurrencies.

Lastly, macroeconomic conditions, such as inflation and currency devaluation, could influence Bitcoin's long-run price. As traditional fiat currencies face challenges, investors may turn to Bitcoin as a hedge against inflation and a store of value, potentially driving its price higher.

In conclusion, while predicting the exact long-run price of Bitcoin is challenging, several factors suggest that it has the potential to appreciate over time. Historical trends, technological advancements, and market dynamics all point to a positive outlook for Bitcoin's long-run price. However, it is essential to approach Bitcoin investments with caution, as it remains a highly speculative asset with significant risks. As the cryptocurrency market continues to evolve, Bitcoin's long-run price will likely be influenced by a combination of these factors, making it an intriguing asset for both investors and enthusiasts.

This article address:https://www.aichavitalis.com/crypto/43d07499882.html

Like!(231)

Related Posts

- Bitcoin Mining Setup Philippines: A Comprehensive Guide

- FOMO Coin Binance: The Future of Cryptocurrency Trading

- Title: How to Transfer Bitcoin to Your USD Wallet: A Step-by-Step Guide

- Bitcoin Price Prediction Reddit 2018: A Look Back at the Community's Predictions

- How to Transfer Bitcoin from Coinbase to Wallet

- Bitcoin October Price History: A Comprehensive Analysis

- Bitcoin Mining 1070 Ti: A Comprehensive Guide

- Bitcoin Price USD Prediction Daily: A Comprehensive Analysis

- Iran Mosque Bitcoin Mining: A Controversial Trend

- The Safest Bitcoin Wallet for iPhone: A Comprehensive Guide

Popular

Recent

How to Withdraw NiceHash to Binance: A Step-by-Step Guide

Bitcoin Price Predictions: The Future of Cryptocurrency

Quadro P6000 Bitcoin Mining: A Game Changer in Cryptocurrency Mining

When Does Bitcoin Mining Reward Half?

When Was Bitcoin Cash Split: A Comprehensive Look at the Event

Bitcoin Price Forecast September: What to Expect in the Coming Month

www Bitcoin Mining Software: The Ultimate Guide to Choosing the Best Solution

When Does Bitcoin Mining Reward Half?

links

- Buying Bitcoin in Texas with Cash: A Guide to Local Stores

- Bitcoin Mining Base: The Heart of Cryptocurrency Ecosystem

- The Growing Trend of Pay for Mining Bitcoin

- How to Make Trading on Binance Easier: A Comprehensive Guide

- What is Bitcoin Cash?

- The Average Bitcoin Price Calculator: A Comprehensive Tool for Investors

- Bitcoin Miner UK Price: A Comprehensive Guide

- Bitcoin Price in June 2012: A Look Back at the Cryptocurrency's Early Days

- The Rise of BAT Binance USDT: A Game-Changing Cryptocurrency Combination